So getting in tune with a stock’s rhythm is essential. By sticking with two these types of strategies, it allows you to build up your portfolio and walk away from the computer.

Swing Trading Forex Vs Stocks Forex Ea For Android

Swing Trading Forex Vs Stocks Forex Ea For Android

It means you look to book your profits before the market reverses.

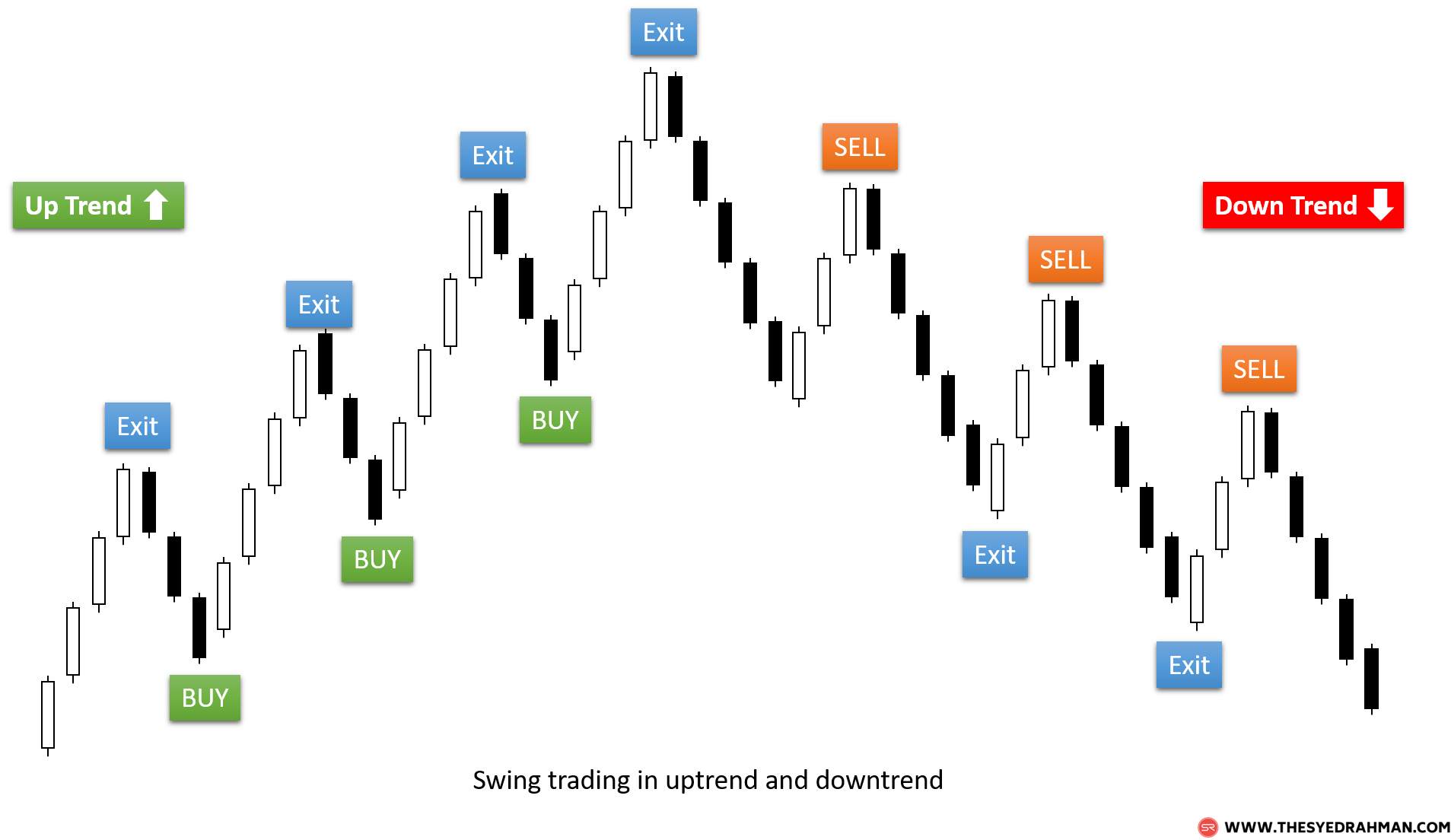

What is swing trading. Essentially you’ll find the lowest point of a trend at the highest point of the trend and you’re trying to capture reversals each time. This speculative trading strategy refers to buying and then selling anywhere from that day to under a month later. The risk/reward ratio of a swing trade is calculated before a trade.

A good amount to begin trading; Swing traders often rely heavily on technical analysis to form their strategy, which they use to know when to enter and exit the market. The gains might be smaller, but done consistently over time they can compound into.

Unlike day traders, who open and close their positions during the same day, swing traders keep their positions open from one day to several days or even several weeks, depending on the market opportunity. Profits can be sought by either buying an asset or. It can be used to trade in forex, futures, stocks, options, etfs and cryptocurrency.

This allows for a quick return with fewer fees. All have their own advantages and all offer similar profit potential. Most fundamentalists are swing traders since changes in corporate.

A swing trading plan will work in all markets starting from stocks, commodities, forex currencies, and much more. A swing trading position is typically held longer than a day trading position, but shorter than buy and hold investment strategies that can be held for months or years. As the duration of the trades is shorter, positions would have to be more closely managed than a position trade.

Because swing trading strategies take several days or even weeks to play out, you face the risks of “gaps” in trading overnight or over the weekend. Swing trading is a trading technique that seeks to capture a swing when the price goes to a complete sideways zone. Then trade this market swing high to the market swing low.

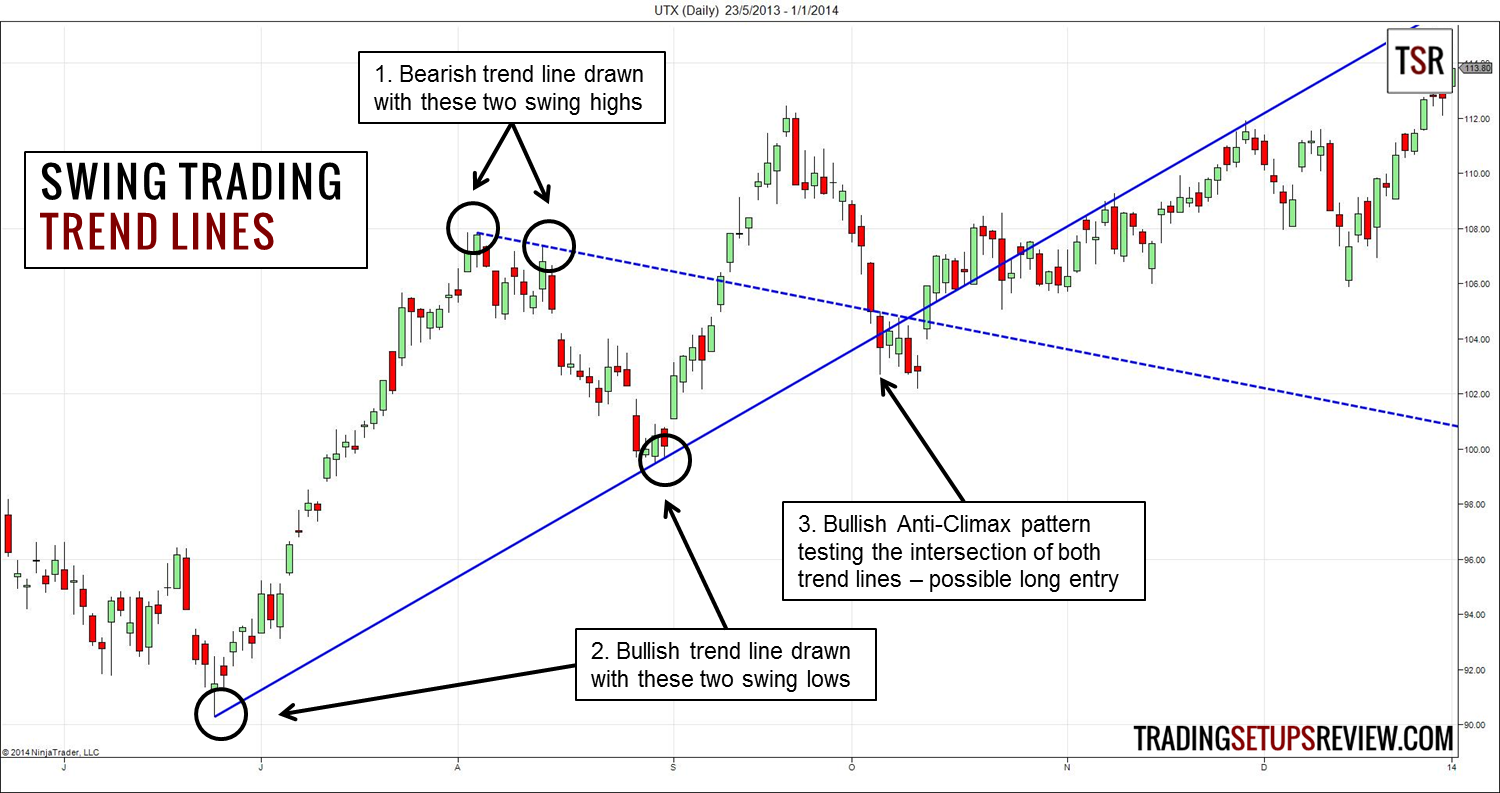

Swing trading refers to the practice of trying to profit from market swings of a minimum of 1 day and as long as several weeks. Trendlines and areas of confluence; Strategi ini sangat memanfaatkan momentum pasar yang besar sehingga mengabaikan pergerakan harga yang kecil.

Yet the secret behind this approach is surprisingly simple. Start with as little as $2,000 for forex swing trading. Swing trading, on the other hand, is an active trading style that looks to profit from those ups and downs (swings) in the market.

Strategi analisa yang digunakan tetap menggunakan analisa teknis maupun fundamental. For instance, if a stock’s price falls for a few days, then recovers back to the previous level, that swing could represent a profit opportunity. Swing trading is also more susceptible to noise in the market.

Swing trading merupakan salah satu strategi unggulan para trader karena waktu trading yang lebih santai dengan periode waktu beberapa hari hingga beberapa minggu. Swing trading is a strategy that focuses on taking smaller gains in short term trends and cutting losses quicker. The importance of interpreting candlesticks;

Which broker to conduct your trades with; Swing trading can be categorized into discretionary swing trading and systematic swing trading. Tentunya fase 2 tetap menjadi fase yang ideal juga untuk swing.

Swing trading is a speculative trading strategy in financial markets where a tradable asset is held for one or more days in an effort to profit from price changes or 'swings'. Like the ebb and flow of water washing against an ocean shore, stocks move in waves. Requirements of a good charting platform;

The main difference is the amount of capital required to start trading each market. The idea behind swing trading is to find a market swing low and trade it upwards to a market swing high. Like any trading strategy, swing trading also has a few risks.

While you still might struggle with the concept of swing trading, you may be more familiar with day trading. In the last 2 months of 2020, you’ve been introduced to swing trading. You’ve learnt about the following:

Swing trading focuses on profiting from short term changes in the price. Swing trading is a short term trading form where you hold your trades for 1 day up to a few weeks at most. A swing trading service is, therefore, a trading service that enlightens you about the factors that move the markets, teaches you how to identify tradable swing opportunities in the markets, and may even offer swing trading signals that show you which stocks to buy or sell, when to place a trade, and when to exit from the trade.

Swing trading positions typically last two to six days, but may last as long as two weeks. Swing trading has been described as a kind of fundamental trading in which positions are held for longer than a single day. For stocks and options start.

The idea is to get out of the trade before the opposing pressure comes in. Swing trading strategies would have more trading opportunities than position trading.

Swing trading strategies that work pdf, senarai jutawan

How to Trade Swings with Indicators

How to Trade Swings with Indicators

Swing Trading Terms Interactive Brokers Bitcoin Short

Swing Trading Terms Interactive Brokers Bitcoin Short

Swing Low Swing High Forex Trading Strategy

Swing Low Swing High Forex Trading Strategy

Swing Trading Forex Dashboard Indicator Mt4 Forex Robot

Swing Trading Forex Dashboard Indicator Mt4 Forex Robot

Identifying swing lows and swing highs Beginner

Identifying swing lows and swing highs Beginner

How to SWING TRADE using price action ( simple swing

How to SWING TRADE using price action ( simple swing

:max_bytes(150000):strip_icc()/dotdash_Final_Swing_Trading_Definition_and_Tactics_Sep_2020-01-3076f5051df14af8a12fdeba61c23144.jpg) Swing Trading Definition and Tactics

Swing Trading Definition and Tactics

Swing Trading In Forex Forex Combo System 4.0.rar

Swing Trading In Forex Forex Combo System 4.0.rar

Swing Trading with Trend Lines Trading Setups Review

Swing Trading with Trend Lines Trading Setups Review

50 Retracement Swing Trading Strategy Trading Setups Review

50 Retracement Swing Trading Strategy Trading Setups Review

Flipping Support and Resistance for Swing Trading

Price Action Swing Trading (PAST) Strategy 01Dec13

Price Action Swing Trading (PAST) Strategy 01Dec13

Swing Trading Strategy FREE 3 Little Pigs Update 22Mar

Swing Trading Strategy FREE 3 Little Pigs Update 22Mar

Part 3 Swing trading Cryptoweek Medium

Part 3 Swing trading Cryptoweek Medium

Swing Trading The Best Way To Trade The Markets Class 1

Swing Trading The Best Way To Trade The Markets Class 1

How To Get Your Swing Trading Strategy YouTube

How To Get Your Swing Trading Strategy YouTube

Advance Swing Trading Strategy ForexCracked

Advance Swing Trading Strategy ForexCracked

swing trading strategies for intraday swing trading

swing trading strategies for intraday swing trading

White Label Forex Trading Platform will enable you to get all the benefits of the MetaTrader 4 automated trading platform and MetaQuotes language with even more exciting functionalities for your own brand

ReplyDeleteWhite Label Forex Exchange is an online forex trading course designed for beginner traders to learn basic and advanced techniques of the forex market. The course is divided into 10 modules that cover topics such as risk management and position sizing strategies along with highly profitable algorithmic trading strategies.

ReplyDeleteWhite Label Mt4 will enable you to get all the benefits of the MetaTrader 4 automated trading platform and MetaQuotes language with even more exciting functionalities for your own brand

ReplyDeleteSaxo Bank Review Is A Great Trading Platform, But Is It The Best? Read This Review To See If It Is The Right Option For You.

ReplyDelete